Characteristics of a Fraudulent Cryptocurrency Address

February 22nd, 2023

Maximizing Blockchain Security: Using blockquiry Visual Explorer to Assess Crypto Addresses

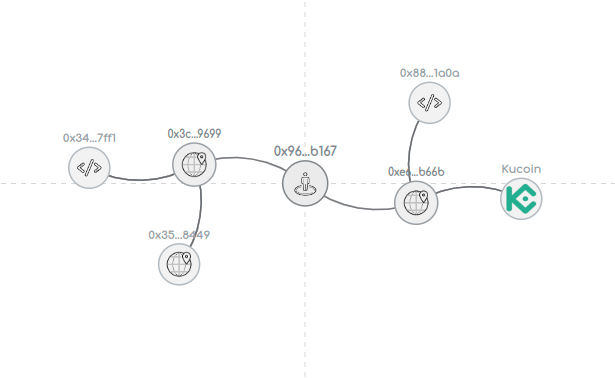

Have you ever wondered how the transparent and decentralized nature of the blockchain allows you to see the history and transfer of assets? This article will explore the nine key characteristics you should look for when evaluating a cryptocurrency address or wallet using blockquiry's Visual Explorer.

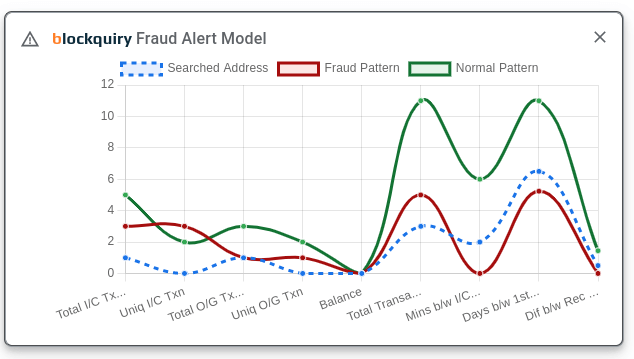

With tools like the blockquiry Visual Explorer, you have a significant advantage over traditional finance when it comes to identifying fraudulent addresses or wallets. Our machine learning models continuously analyze and compare fraudulent and non-fraudulent cryptocurrency addresses, providing you with an easy-to-understand visual model to help you assess the characteristics of an address belonging to an unknown entity.

The nine key characteristics we'll be exploring include:

- Average number of incoming and outgoing transactions

- Number of unique incoming and outgoing transactions

- Balances

- Total transactions

- Time between incoming and outgoing transactions

- Number of days between the first and last transaction

- Difference between the total sent and received value

Fraudulent Addresses vs. Non-fraudulent Cryptocurrency Addresses

Our models show that fraudulent addresses have fewer incoming transactions than non-fraudulent ones, with a median of 3 vs. 5. Scammers create "temporary" addresses to receive funds from scams, and scams are complete, they abandon those addresses. In contrast, non-fraudulent addresses are used more frequently for legitimate transactions.

Additionally, fraudulent addresses tend to have more unique incoming transactions than non-fraudulent ones, with a median of 3 vs. 2. This is because non-fraudulent addresses often send and receive funds from the same place, such as an exchange, whereas fraudulent addresses rarely do.

Regarding outgoing transactions, fraudulent addresses have fewer outgoing transactions than non-fraudulent ones, with a median of 1 vs. 3. Scammers typically funnel all their stolen funds to a central wallet. In contrast, non-fraudulent addresses are used more frequently for legitimate transactions and send funds to many addresses.

Although both fraudulent and non-fraudulent addresses tend to have a median balance of 0, the difference between the total sent and received value tells a different story. Our data shows that fraudulent addresses typically have a median difference of 0 between the total sent and received value, while non-fraudulent ones have a median difference of 1.44. Fraudulent addresses are usually used for a specific purpose, such as receiving funds from a scam, and have no interest in keeping any balance in their scam wallet. In contrast, non-fraudulent addresses have a more balanced usage between sending and receiving funds and tend to keep some balance in their wallets.

The overall transaction volume is another factor to consider. Fraudulent addresses typically have fewer total transactions than non-fraudulent ones, with a median of 5 vs. 11. Fraudulent addresses are used for a specific purpose, whereas non-fraudulent addresses are used more frequently for legitimate transactions.

The average time between incoming and outgoing transactions tells a story of scammers being in a hurry to move funds from fraudulent wallets to cash out before being caught. Our data shows that fraudulent addresses typically have a median time of 0 minutes between incoming and outgoing transactions, whereas non-fraudulent ones have a median of 6 minutes. In contrast, non-fraudulent wallets have more extended periods between transactions.

blockquiry Visual Explorer

Lastly, the scammers behind these fraudulent addresses aim to move the stolen funds out of the wallet as quickly as possible to avoid detection. This explains why our data shows that fraudulent addresses are typically used for a shorter period, with a median of only 5.24 days between the first and last transaction. In contrast, non-fraudulent addresses tend to be used for legitimate transactions over a more extended period, with a median of 80.99 days between the first and last transaction.

It's a concerning reality that as traditional crimes decrease in Western countries, cyber and crypto crimes are increasing at an alarming rate. What's even worse is that compared to conventional crime victims, cyber and crypto crime victims are less likely to report those crimes to law enforcement. This underreporting puts us at a disadvantage regarding our ability to learn and develop the appropriate response for those types of incidents.

At blockquiry, we take blockchain security and safety seriously, and that's why we strongly encourage any victims of cyber crimes to report their incidents to the relevant law enforcement authorities. We want to help educate and protect users from crypto and cybercrime, and we provide our tool, blockquiry Visual Explorer, to help you identify fraudulent wallets and track the movement of your funds across the blockchain.

If you need help or have been a victim of crypto or cybercrime, click on the link to access the Directory of US State and Local Cybercrime Law Enforcement Agencies.

Follow us